The real winner of the AI boom so far? Big Cloud

How Microsoft, Google, and Amazon are concentrating even more power in the age of AI.

Greetings all, hope everyone’s hanging in there.

So I’m not the only one who thinks GPT-5 was a joke; as Axios noted, it “landed with a thud.” The reverberations of the failed launch continue to be felt throughout the industry, animating the idea—and many a think piece—that the AI revolution may well have hit a wall. But there’s one group in big tech that most certainly has not: cloud providers. Meanwhile, news broke that Trump wants to remove the export controls on Nvidia chip sales to China, as long as the company gives the US government a 15% cut of its sales, despite such a deal being rather unconstitutional. Tech oligarchy in action, folks!

We’ll cover all that and more in today’s edition, but first, in order for me to continue getting this critical reporting on AI past the export controls, consider upgrading to a paid subscription. This is a 100% reader-supported publication and I can only do this work thanks to those of you who chip in $6 a month (or $60 a year). At this point, I’m working many more than 40 hrs a week reporting, researching, and writing these pieces, because there’s simply so much to cover. You’ll get access to Critical AI reports, and I’ll even take a cue from President Deals and sweeten the pot: if you upgrade to a yearly paid subscription this week, I’ll send you a signed copy of one of my books. Just shoot me an email at briancmerchant(at)proton.me with the receipt, tell me which you’d prefer, and where I should ship it. (While supplies last of course!)

Also perhaps of interest: I joined KQED’s Forum on Wednesday morning, along with WIRED’s Zoe Schiffer and MIT Tech Review’s Mat Honan to talk about GPT-5 and the AI bubble with host Alexis Madrigal. (A good time to note, I suppose, that I’m reading Alexis’s book, the Pacific Circuit, and so far it’s very good.) It was, I thought, a great conversation. Okay! Enough housekeeping. Onwards, and hammers up.

The growing power of Big Cloud

How Microsoft, Google, and Amazon are quietly concentrating their power in the age of AI.

Back in July, Nvidia became the first public company to reach a $4 trillion valuation. Despite this being, as the New York Times pointed out, one of the fastest ascents in Wall Street history, the milestone was curiously unremarked upon in wider culture. There are probably a number of reasons for this. One is that it’s a straightforward, yet unsatisfying, or even troubling narrative: Nvidia became a $4 trillion company because it sells chips to the tech companies building AI products, and those products are at the center of a boom (and very probably a bubble) that has utterly consumed Silicon Valley (and also much of the US economy).

Nvidia is selling shovels during the AI gold rush, as many have observed. As such, it has become the bellwether for the entire AI boom: As long as AI companies are expanding operations and building more data centers, as they are right now, they will need more Nvidia chips, and Nvidia’s value will continue to rise. This is how, as we’ll dive into later, Nvidia CEO Jensen Huang landed himself in the position to negotiate exemptions to national export controls ostensibly put in place for matters of national security directly with the president of the United States.

But Nvidia is not the only bellwether. There’s a reason that Microsoft—not Apple or Meta—became the second $4 trillion company, just weeks after Nvidia crossed the threshold. (Another reason the Nvidia news didn’t make as much of a splash is that the sight of a tech company vaulting past trillion-dollar milestones has become much more common and less notable, to the detriment, I think, of the stability of the global economy. I digress.)

There are a number of reasons that investors are bullish on Microsoft right now; its enterprise software suites are ideal for deploying AI automation tools, its early deal with OpenAI linked the companies and gave the older giant a reputational boost, as well as an enormous client for its cloud services. And that, I think is the biggest takeaway from Microsoft’s surging valuation. As Bloomberg reported, “Microsoft reported better-than-expected growth in its cloud business, and its closely-watched Azure cloud-computing unit posted a 39% rise in sales, handily beating the 34% analysts expected.”

It’s all about the cloud. New research from scholars David Widder and Nathan Kim helps make clear that there’s another major beneficiary of the AI boom that’s going largely unremarked upon; what the researchers call Big Cloud. I haven’t seen nearly as much attention paid specifically to the fortunes of the tech giants who sell cloud compute—primarily Amazon, Google, and Microsoft—as I have paid to Nvidia. And yet, Big Cloud is selling shovels hand over fist, too.

See, you really need two basic ingredients, infrastructure-wise, to train, develop, and run AI models: Chips and compute. And these days, most companies’ compute is handled on the cloud.1 Most of the cloud compute, in turn, is owned by Amazon’s Web Services, Google’s Cloud, or Microsoft’s Azure. Those companies control two thirds of the cloud compute market worldwide, a position that’s only improved as companies around the world have rushed to join the AI race. After all, they’ve largely turned to—or been actively courted by—Big Cloud.

“Microsoft's latest valuation shows that the big winners in the AI race are Big Cloud,” David Widder, who’s a researcher at Cornell Tech and incoming professor at the University of Texas at Austin. “While we wait to see if AI's promises will come through, Microsoft is getting rich off the hype, as more and more businesses and services we depend on are sucked into the cloud.”

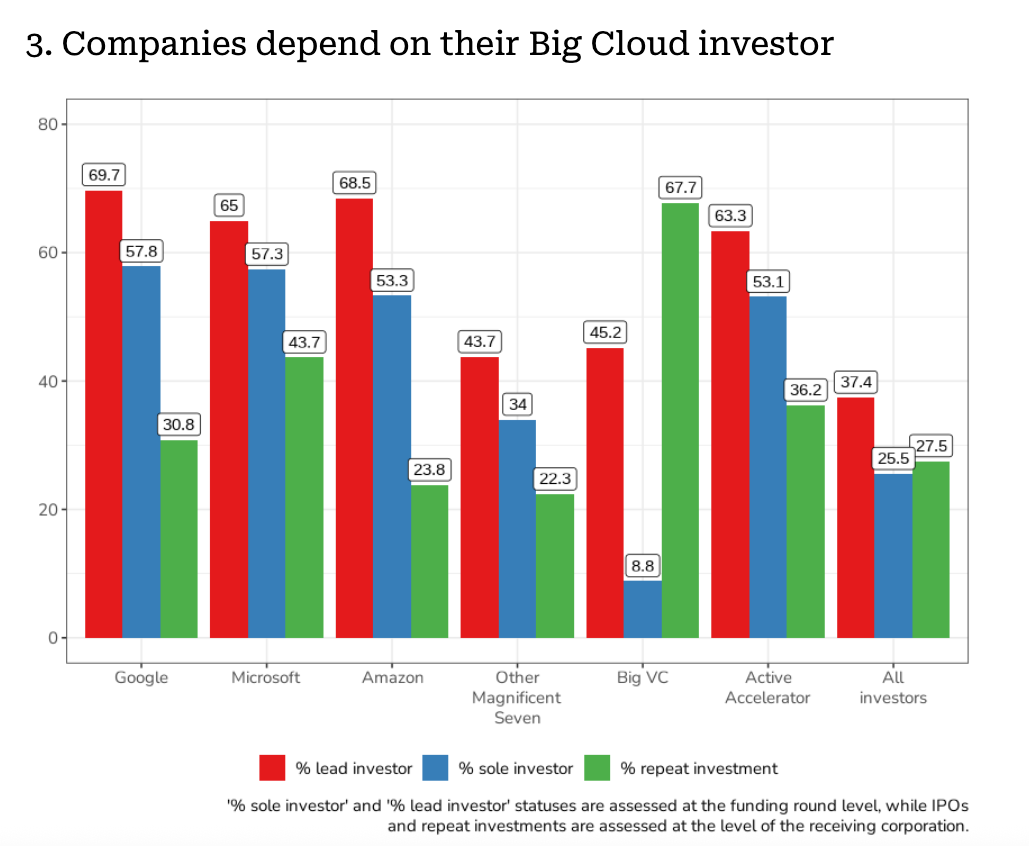

Widder and Kim’s report, which is based on an analysis of thousands of investment deals in the AI boom years, shows how Microsoft, Amazon, and Google have wielded their enormous resources and leveraged their power to expand their share of the cloud market, and to lock more companies into their services. They’ve done so by investing in thousands of startups and smaller companies, inking deals that Widder and Kim argue are anticompetitive in nature, leaving the startups committed indefinitely. And it’s taking place on a massive scale.

Here’s a small glimpse at that scale, from the report (emphasis mine):

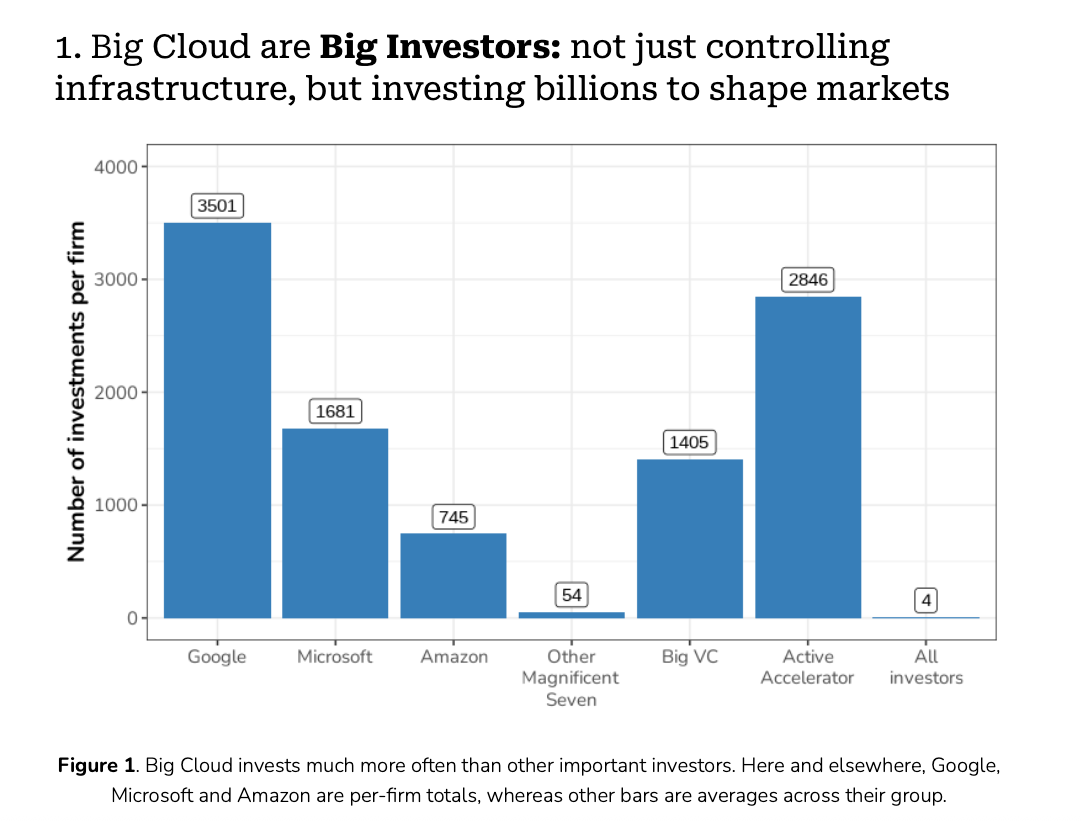

Big Cloud invests as frequently and at similar amounts to the largest venture capital firms and startup accelerators. Further, Big Cloud invests about ten times as often as other Big Tech companies, and ten to a hundred times more in total dollar amounts.

Google is by far the leader here, with Microsoft in second place, and both invested in more companies than the biggest VC firms. Notably, the other “Magnificent Seven” big tech companies—Meta, Apple, Tesla, and Nvidia—are making far fewer investments, period.

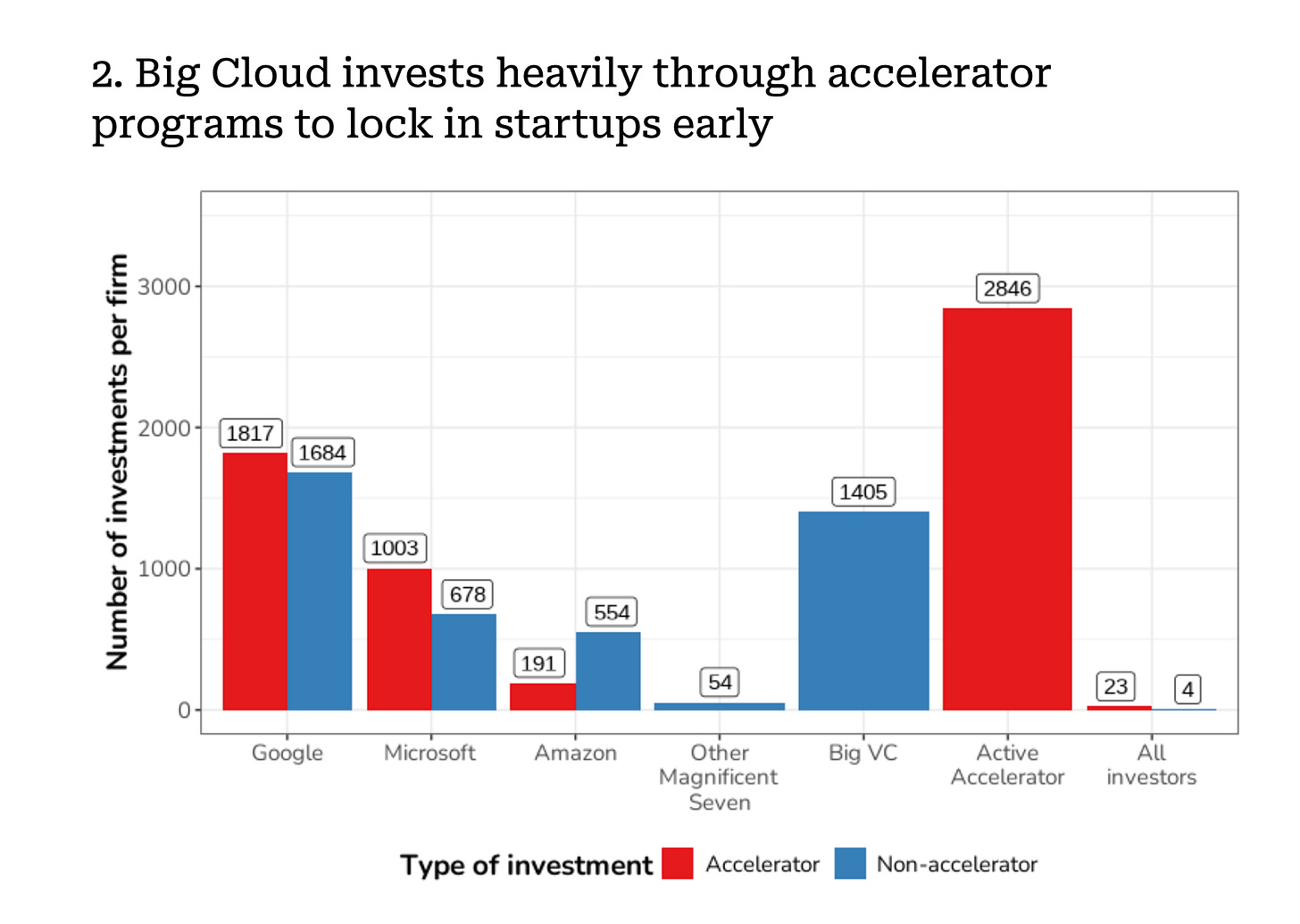

These deals often incentivize startups to use Big Cloud’s services, and leave them both technically and financially dependent. As Widder and Kim put it, “the sheer scale of these investments allows them to pursue anticompetitive practices unchecked.” One of the main ways that Big Cloud expands its dominance is by running accelerator programs across the globe:

From the report:

These accelerator programs are often location or technology specific, enabling Big Cloud to expand their market power in emerging technologies or enter markets. For example, Google for Startups’ “Africa Program” offers up to $350,000 in Google Cloud credits, “strategic guidance” and “mentorship from Googlers and industry leaders”. Two other Google programs, established in 2020, are Google’s “Black Founders Fund” which operated within the US, and their “Latino Founders Fund” which operated across the Americas. The former program was ostensibly open to any business type and was said to “strengthen communities, and create generational change”, while the latter was scoped to only startups using AI. Both offered cloud compute credits and also equity-free cash awards.

After an investment, when a startup is ensconced in one of Big Cloud’s product ecosystems, enticed by free cloud credits and discounted rates, they risk being locked in, subject as they are to “egress fees, minimum spend requirements, tying and bundling.” Often, there’s no other entity on the ground that can offer the compute new AI startups need, and Big Cloud is essentially the only game in town. “Our analysis shows that Big Cloud builds financial dependence via their investment, intensifying other forms of infrastructural, technical, and contractual dependence,” the scholars write. “Big Cloud companies are investing in a way that brings many of the same risks as conventional forms of vertical integration, yet is less likely to attract scrutiny.”

“Concentrating so much power and commerce in the cloud means that other nations' highly-publicized efforts for ‘digital sovereignty’ and ‘AI sovereignty’ are under threat,” Kim. “You can't have ‘sovereign’ AI if it's, at the end of the day, funded by or built on the infrastructure of Big Cloud.”

The authors call for antitrust action to separate the cloud business from core operations, more regulatory oversight, and for more recognition of how the tech giants are expanding their infrastructural dominance amid the AI boom. Vertically integrating without, you know, actually vertically integrating. ”Much more attention is needed on how Microsoft and other Big Cloud giants are quietly investing in thousands of small startups as they attempt to bend tech ecosystems towards cloud dependence,” Widder tells me.

There’s more detail in the study, which is worth a read.

“We're turning into a more unstable economy in general because of the consolidation our report explores,” Kim says. “The sheer size of AI investment (especially capex) by these cloud giants is creating a ‘stimulus’ effect that masks underlying economic weakness. When real productive gains fail to materialize and the AI economy finally slows down or the bubble bursts, we'll all have to pay the price.”

AI ACTION ALERT: Artists and creators are circulating a petition to be sent to California senators in support of CA Bill AB 412, aka the AI Copyright Transparency Act.

The bill would force tech companies to be, well, transparent about what’s in the datasets they use to train LLMs, and require AI developers to inform copyright holders about how their works are used. Obviously, the AI companies hate it. You can sign the petition here.

Critical AI Report, August 14, 2025

Today:

-Nvidia, Trump, and how the tech oligarchy operates in Washington

-Leaked policy docs and a tragic story reveal Meta’s AI chatbots to be an utter nightmare—and a continuation of its past

-Updates on the struggle over AI in journalism newsrooms

-Good long reads on GPT 5 and beyond

A snapshot of the silicon oligarchy in action

If you’ve been wondering what “the tech oligarchy” looks like on the ground, in motion, especially now that Elon Musk has long since slunk out of the White House, you might consider taking in this particular scene: